Graphics: Foreign capital is not fleeing China

There have been reports recently by some Western media outlets that foreign capital is leaving China. However, official data shows that the country is still attractive to foreign capital and is leading the world in foreign capital inflows.

Foreign direct investment (FDI) into the Chinese mainland in the first eight months of 2022 rose 20.2 percent year on year to $138.4 billion, according to the Ministry of Commerce (MOFCOM). Its global share of FDI ranked first and was 19.5 percent in the first quarter of this year, according to the Organization for Economic Cooperation and Development (OECD).

(Graphics by Du Chenxin)

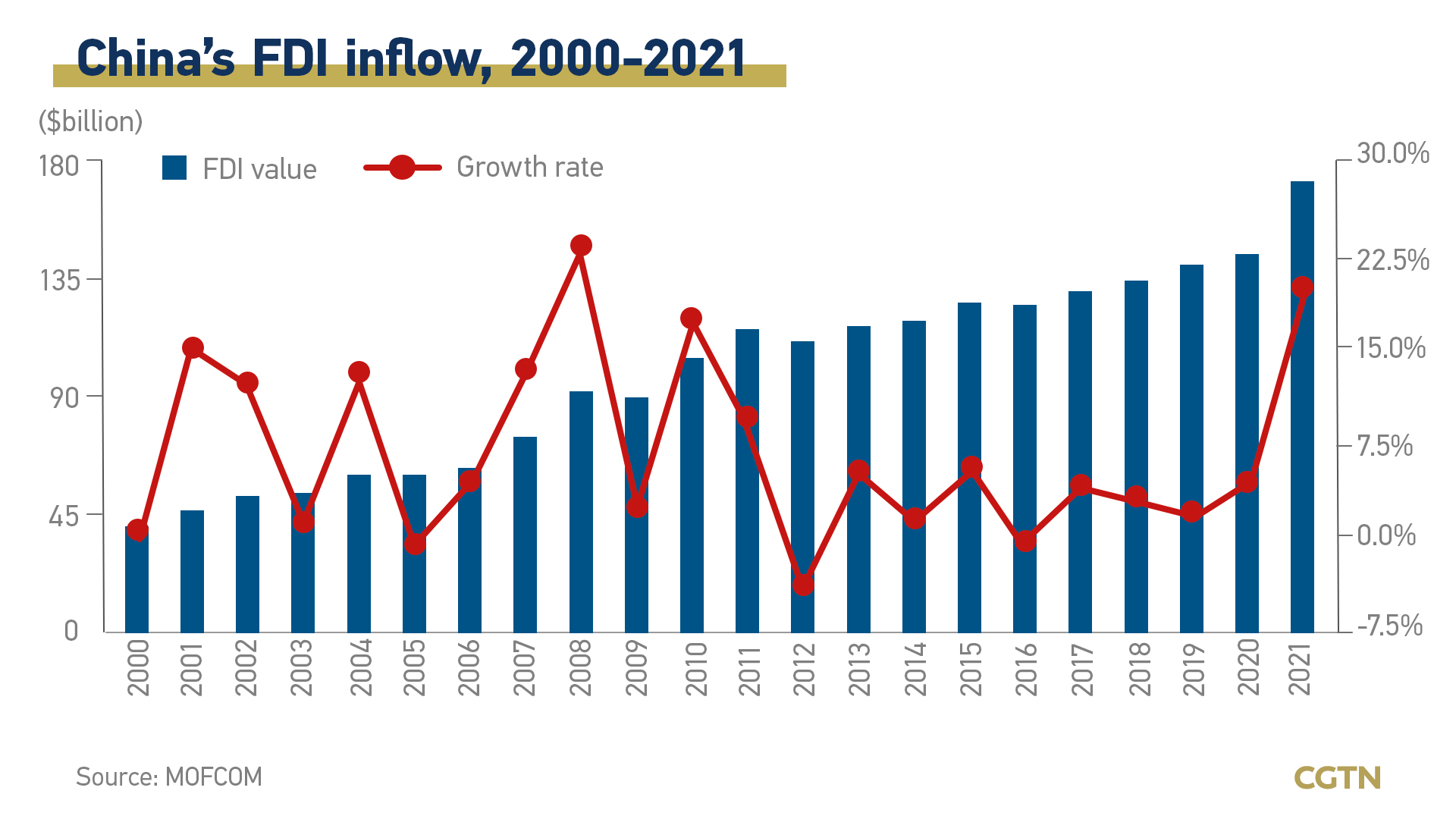

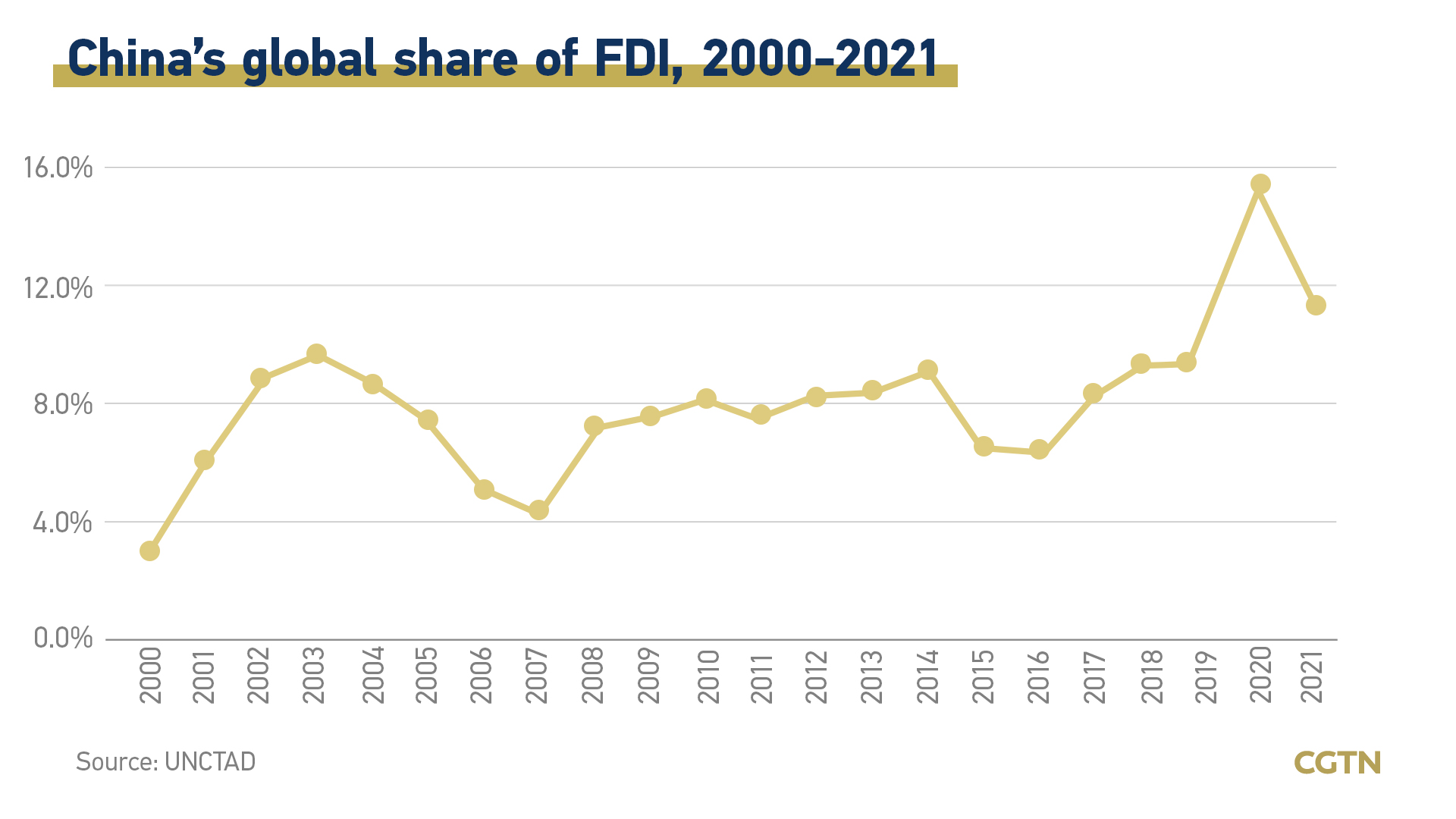

Thanks to China's rapid integration with the global industrial chain, its FDI inflow has been expanding speedily since 2000. Despite a slowdown amid the 2008 global financial crisis, its FDI inflow has recovered quickly and increased about 1.5 times from $117.6 billion in 2013 to $173.5 billion in 2021, according to MOFCOM.

Global FDI shrank by 42 percent in 2020 due to the impact of the COVID-19 pandemic, while FDI inflow into China achieved growth against the downward trend, accounting for 15.5 percent of the global total, data from the United Nations Conference on Trade and Development (UNCTAD) showed.

(Graphics by Du Chenxin)

The Hong Kong Special Administrative Region (SAR) has taken a dominant position among the sources for FDI inflow into the Chinese mainland. In 2020, about 70.8 percent of FDI inflow into the Chinese mainland came from Hong Kong SAR, while around 40.4 percent of foreign-invested enterprises (FIEs) on the Chinese mainland were from Hong Kong SAR.

"There has been a substantial increase in the funds raised by companies from the Chinese mainland in the Hong Kong market over the past years, whether it is IPO or Chinese-issued U.S. dollar bonds," Ding Anhua, chief economist with China Merchants Bank, said in late September.

(Graphics by Zhu Shangfan)

In recent years, although the value of China's FDI inflow has been increasing, the structure of FDI inflow has been differentiated. The proportion of FDI in manufacturing has dropped significantly, while that in the service sector, such as finance, wholesale and retail, leasing and business services, has risen sharply.

The FDI in the manufacturing industry accounted for 21 percent of China's total FDI inflow in 2020, down 49 percentage points from 2000, while the FDI in the service industry accounted for 66 percent in 2020, up 50 percentage points from 2000. The inflow in the service industry just made up for the outflow in the manufacturing industry.

(Graphics by Zhu Shangfan)

"The FDI value in the service industry has grown significantly, especially in research and development, information services, computer services and software," said Ding.

The China Council for the Promotion of International Trade (CCPIT) said in a report released in April this year that over 50 percent of the FIEs surveyed still regard China as the world's top investment target.

In the first quarter of this year, more than 70 percent of FIEs increased their investment in China by over 5 percent, said the CCPIT in a report released in May this year.

The CCPIT said that China has a huge domestic consumer market, as it has a middle class of 400 million people with strong spending power, and that there are complete industrial clusters in the Yangtze River Delta and the Pearl River Delta, which are also attractive to foreign investors.

According to a report unveiled by the CCPIT in July this year, 18.5 percent of FIEs surveyed said they expanded their business scale in the second quarter of this year, with an increase of 2.1 percentage points from the first quarter, while 72.5 percent of FIEs said they maintained their business scale, with an increase of 1.5 percentage points from the first quarter.

Between January and August in 2022, the FDI from South Korea, Germany, Japan, and the United Kingdom climbed by 58.9 percent, 30.3 percent, 26.8 percent, and 17.2 percent, respectively, according to MOFCOM.

- GLOBALink | China is playing increasingly important role in mathematics: Artur Avila

- Over 1,000 new foreign-funded manufacturing firms established in China's Guangdong in 2023

- China's e-commerce logistics index up in 2023

- UNESCO IISTEM to improve sci-tech innovation talent training in China: education ministry

- GLOBALink | China launches new air cargo route linking Shenyang, Chicago