China's cross-border capital flows stable, forex market balanced in H1

"Since the second quarter, the national economy has gradually recovered, and various economic indicators have shown marginal improvements. The flexibility of the RMB exchange rate has increased and remained basically stable," said Wang Chunying, deputy administrator and spokesperson of the State Administration of Foreign Exchange (SAFE).

Cross-border financial flows were generally stable with net inflows increasing in the second quarter, according to Wang. Foreign-related receipts and payments by banks on behalf of clients showed a small surplus of two billion U.S. dollars in the first half of the year: there was a deficit of 30.1 billion U.S. dollars in the first quarter but a surplus of 32.2 billion U.S. dollars in the second quarter.

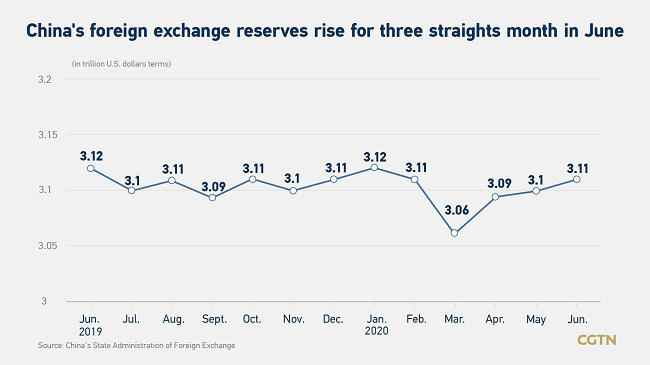

The size of foreign exchange reserves increased steadily in China, as forex reserves expanded to 3.11 trillion U.S. dollars at the end of June. This represented an increase of 4.4 billion U.S. dollars from the end of 2019, Wang said. The forex reserves in June added 10.6 billion U.S. dollars and rebounded for three consecutive months.

The rate of foreign exchange buying dropped, and the forex financing of enterprises increased steadily. In the first half, the rate of forex buying, which means the ratio of clients buying forex from banks to the overseas expenditure of forex, stood at 63 percent, down 3.5 percentage points compared to the same period of last year. At the end of June, Chinese banks' forex loans at home rose by 52.4 billion U.S. dollars, compared to the end of 2019, according to SAFE.

The rate of forex selling grew steadily, and market players showed a declining willingness to hold foreign currency. In the first half, the rate of forex selling, which means the ratio of clients selling forex to banks to clients receiving forex from overseas, stood at 66 percent, up two percentage points. At the end of June, forex deposits of enterprises and individuals at home dropped by five billion U.S. dollars compared to the end of 2019, according to SAFE.

"The global epidemic situation and the world economic situation are still severe and complex with many uncertainties… The international financial market has also experienced violent shocks," said Wang. "Meanwhile, the domestic epidemic control and resumption of work and production have achieved major results… In this case, the data just released shows that China's forex reserves and expenditure are generally stable, and the forex market shows relatively high resilience and resistance to risks," Wang added.

- GLOBALink | China is playing increasingly important role in mathematics: Artur Avila

- China's cross-border capital flow to be further stabilized in 2024: central bank

- China's e-commerce logistics index up in 2023

- UNESCO IISTEM to improve sci-tech innovation talent training in China: education ministry

- GLOBALink | China launches new air cargo route linking Shenyang, Chicago