Foreign investors target M&A in Chinese market amid pandemic

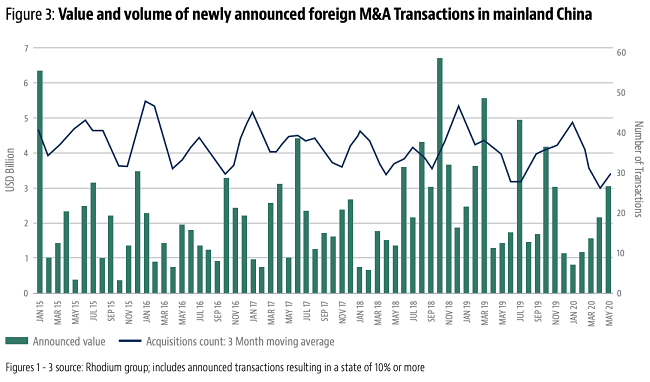

Although the pandemic and escalating China-U.S. tensions have hit global business, including Chinese investment overseas, inbound mergers and acquisitions in China totaled 9 billion U.S. dollars in the first five months of 2020 thanks to the country’s further opening-up.

In the first five months, China’s inbound activity outperformed outbound activity for the first time in a decade, according to a recent report from international law firm Baker McKenzie.

Source: Baker McKenzie

Starting this year, foreign financial institutions can have wholly-owned subsidiaries in China and operate in China without setting up joint ventures. Peter Lu, a partner at Baker McKenzie, said this is one example of a new policy that has excited Western investors.

Amid the pandemic, some assets that were not available have been put on the market, Lu said, noting there are more opportunities for Chinese companies to invest in European assets now, although risks of increasing regulation remain for them.