Global investors remain bullish on Chinese market

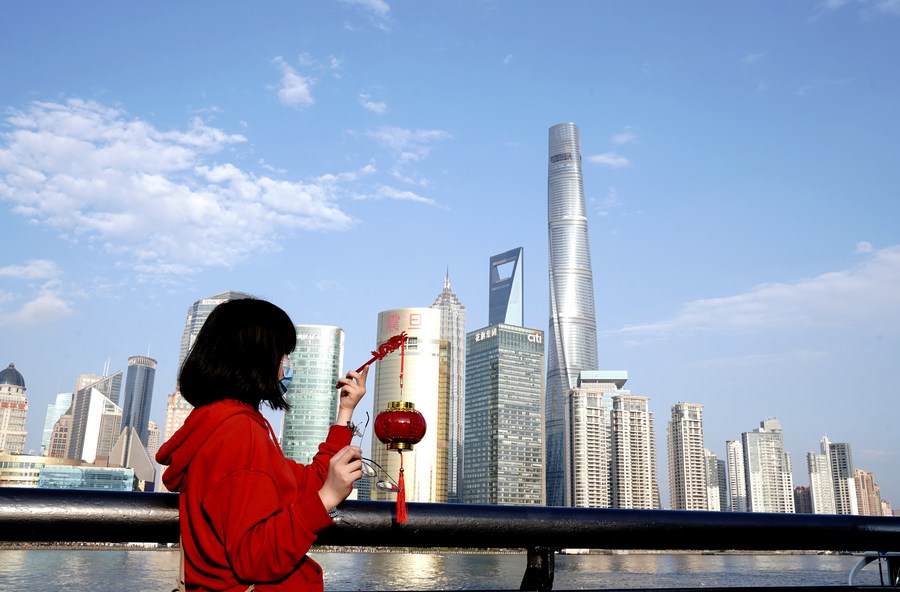

A tourist visits the Bund during the Lunar New Year holiday in east China's Shanghai, Feb. 14, 2021. (Xinhua/Zhang Jiansong)

"China is still on track for decent GDP growth over the next decade," said Victoria Mio, director of Asian Equities at Fidelity International, pointing to increasing purchasing power by the middle class.

As an influx of money from around the world keeps flowing into China, global investors have recently voiced their continuous confidence in the Chinese market.

"We want to be part of the Chinese business ecosystem," said Gustavo Junqueira, president of InvestSP, a government investment agency in Sao Paulo, Brazil.

"It is very important for Sao Paulo to have a foot in China," Junqueira said, as the government of Sao Paulo on Thursday launched an investment guide for Brazilian companies.

In the United States, the asset management sector is also optimistic about China's market prospects.

Some of the biggest names in asset management said "China's growth story remained attractive" and it is still a good time to invest, according to a recent CNN analysis that examines the responses to the recent regulatory moves adopted by Chinese authorities.

People shop at the Yangtze River 180 art district in Hefei City of east China's Anhui Province, Aug. 7, 2021. (Photo by Xie Chen/Xinhua)

"The case for China in the long-term is intact," Luca Paolini, chief strategist for Pictet Asset Management, an arm of Swiss private bank Pictet Group, which has 746 billion U.S. dollars assets under management, was quoted as saying in the article.

Pictet isn't alone. As CNN reported, many of the biggest names on Wall Street, including Fidelity, Goldman Sachs and BlackRock, are also advising their clients to "keep buying, albeit cautiously."

Victoria Mio, director of Asian Equities at Fidelity International, expressed optimism in the article about the future of the world's second largest economy.

"China is still on track for decent GDP growth over the next decade," she said, pointing to increasing purchasing power by the middle class.

Some firms, the article said, are optimistic about other Chinese assets.

Paolini pointed out that the yuan has performed better than other major currencies this year, and Chinese government bonds are also overperformers.

"Clearly, China remains fully 'investable' for foreign investors," he noted.

Tourists take a sightseeing boat at the Victoria Bay in Hong Kong, south China, June 12, 2021. (Xinhua/Wu Xiaochu)

Bullish on the prospects of the Chinese market, Fidelity International has applied to set up a fund management company that it fully owns. The application was approved by China's top securities regulator in August.

Data from the stock and bond markets is another testament to the Chinese market's attractiveness for foreign investors.

According to statistics from the Hong Kong Stock Exchange, foreign investors have increased their holdings of shares in Shanghai and Shenzhen via trading links every month since November, "and it is a similar picture in China's bond market," a recent Bloomberg report said.

Noting that China's push for "shared prosperity" could help the country maintain long-term growth, the report said some market pundits have also expressed their optimism on the future of the Chinese economy.

"We feel that the recent regulations are targeted to streamline the future structure of economic growth toward higher quality growth and more balanced growth," Chris Liu, a senior portfolio manager for China Equities at Invesco Hong Kong Ltd., was quoted as saying in the report.

Photo taken on July 2, 2021 shows a duty-free shopping mall in Haikou, south China's Hainan Province. (Xinhua/Guo Cheng)

Pascal Blanque, chief investment officer of Amundi SA, whose firm oversees 2.1 trillion U.S. dollars globally, also said in the report that China's recent measures to regulate the market have "opened up interesting opportunities."

Investors can take advantage of the opportunities "to increase their allocation to Chinese equities in the global portfolio," Blanque and his colleagues said in a note this month.

In Switzerland, the 111-year-old family-owned Swiss biscuit company Kambly has also expressed its growing interest in the steady demand of the Chinese market.

"I think China is a very, very interesting market for Kambly because we offer a Swiss quality product with fine milk, fresh butter made with love and true quality. The understanding in China for those products is definitely present," said Nils Kambly, CEO and delegate of the Board of Directors of the company.

China's willingness to tackle the COVID-19 pandemic as well as its commitment to opening up and a level playing field are attractive to foreign direct investment, said Luxman Siriwardena, managing director of Sri Lanka-based policy and advocacy group Veemansa Initiative.

"China's huge market and moderately prosperous society create demand. This provides an opportunity for multinationals and small-sized companies alike overseas to invest in China," he said.