Baltic Exchange releases weekly shipping market report

BEIJING, Nov. 30 (Xinhua) -- The Baltic Exchange has published its weekly report of the dry and tanker markets for Nov. 22-26, 2021 as below:

Capesize

The Capesize market was a mixed bag this week as routes ebbed and flowed giving little clear direction for traders. The market carried through positive sentiment from the prior week, yet was unable to sustain gains on the 5TC by midweek and bounced by close on Friday as the 5TC settled at $32,393, up $2,455 week on week. Weather concerns earlier in the week disrupted tonnage schedules coming from North Asia, which put pressure on the routes in the region. The Pacific West Australia to China C5 closed the week at $12.164 while the Transpacific C10 settled at $31,598. The positive bump to close the week was led by strengthening in the Brazilian market to Asia as the C3 lifted $1.61 to settle at $27.785. The timecharter route Brazil-China C14 still lags the other regions as it closed out the week at $27,027. Further north, the Atlantic Basin had minimal change at the end of the week but has been the more constant region throughout. Still commanding a premium to the other regions the Transatlantic C8 settled at $37,950 on the back of minimal trading yet relative tight vessel supply in the region.

Panamax

The Panamax market witnessed an impressive rebound this week gaining back the losses experienced last week. The market ended the week on a more solid footing. In the Atlantic, as much of the early tonnage was cleared away, this paved the way for improved levels as a decent amount of fresh demand came to the fore especially from the Americas. This in turn added pressure to some of the shorter duration trips. Close to $35,000 was achieved for a trip via Port Kamsar to Germany was the highlight. Kamsarmax tonnage with a delivery AG/WC India position were seen to be achieving in the region of $23,000 for trips via EC South America. Asia began the week on a slow burn with little action of note. However, by midweek some improved support saw rates perk into life - particularly from NoPac. An 87,000dwt delivery Japan achieving $22,000 for a trip via NoPac redelivery Singapore-Japan.

Ultramax/Supramax

Sentiment changed direction after last week’s falls, albeit slightly tempered, as brokers said better levels and activity levels were seen from Asia. Whilst demand returned from the US Gulf in the Atlantic, other areas remained subdued. Period activity was limited but a 56,000dwt open Arabian Gulf was fixed for five to seven months trading at $22,000. From the Atlantic, a 63,000dwt was heard fixed from the US Gulf for a transatlantic run in the low $40,000s. A 63,000dwt was heard fixed for a scrap run from the Continent to the East Mediterranean at around $41,000. There was better activity from Asia with more enquiry from Indonesia. An ultramax open Philippines fixing a trip via Indonesia redelivery Bangladesh at $27,000. Nickel ore runs saw a 57,000dwt fixing delivery South China via Philippines redelivery China in the very low $20,000s. From the Indian Ocean, a 63,000dwt was heard fixed delivery South Africa trip redelivery Pakistan at $25,000 plus $480,000 ballast bonus.

Handysize

The continuous drop of the BHSI ended this week with the resurgent Asia Markets turning the tide. Despite a holiday in Japan, we have seen more activity with a 38,000dwt rumoured to have been fixed for a trip from Japan to the Continent at $20,000. A 38,000dwt open in South Korea fixed a trip to the US Gulf with an intended cargo of steels at around $19,000. A 35,000dwt open in Vanino was fixed for a trip via Vancouver back to China at $19,000. East Coast South America remained positive with a 34,000dwt fixed from West Africa via the River Plate back to Abidjan at $30,500. A 37,000dwt fixed from the Mississippi River to Morocco with an intended cargo of grains at $27,750. A 34,000dwt open in Turkey was fixed for a trip to the US Gulf at 28,000. A 36,000dwt open Cristobal fixed for three to five months with Atlantic Redelivery at $27,000.

VLCC

Another slight slippage of the rates was seen this week. For the 280,000mt Middle East Gulf to US Gulf (Cape/Cape routing) trip, rates are maintained at WS21.5 level. However, the rate for 270,000mt Middle East Gulf to China eased almost a point to just below WS42 (a roundtrip TCE of $135/day). In the Atlantic, rates for 260,000mt West Africa to China slipped a point to a shade under 43.25 (a TCE of $2.8k/day roundtrip) and 270,000mt US Gulf to China shed $59k to $5.35m (a TCE of $8.9k per day roundtrip).

Suezmax

In West Africa, the market eased further with the rate for 130,000mt Nigeria/UK Continent down three points week-on-week at WS58 (showing a roundtrip TCE of about $470/day). The market for 135,000mt Black Sea/Med fell seven points to WS65 (a TCE roundtrip of about minus $4.4k per day). Meanwhile, for the 140,000mt Basrah/Lavera market, there has been a little interest seen and the market is now assessed 2.5 points firmer than a week ago at WS34.5. This is on the back of Turkish refiners who struggled to garner interest at last week’s level of WS32.5 and having to cover at WS35 with a Greek owner for a Basrah/Turkey cargo.

Aframax

In the Mediterranean, the market for 80,000mt Ceyhan/Lavera took another tumble this week with rates coming off 17 points to a touch above WS98 ($5.2k per day TCE roundtrip). In Northern Europe the market for 80,000mt Cross-North Sea softened by six points to WS103.5 (a TCE of about $780/day). The rate for 100,000mt Baltic/UK Continent lost nine points to close to the WS82 mark (a TCE of about $7.3k per day roundtrip). On the other side of the Atlantic, the market had a flurry of activity in the early part of the week, allowing players to enjoy the Thanksgiving Holiday. At the midpoint of the week the 70,000mt Caribbean/US Gulf rate was down 2.5 points to WS114 (a TCE of $6.5k/day roundtrip). The rate for 70,000mt East Coast Mexico/US Gulf route had three points taken out of it at WS115 ($8.1k/day TCE roundtrip). The market for the 70,000mt US Gulf/UK Continent trip had a much more positive few days with the rate rising for each fixture, climbing 14 points overall to WS117.5 (a TCE of $9.9k/day roundtrip. However, basis 1-way economics this improves significantly).

Clean

The Middle East Gulf has been balanced this week. On the LR2s TC1 has held stable at around the WS110-112.5 region, returning an approximate round trip TCE of $7.5k/day. The LR1s have clung onto current levels despite tonnage outweighing enquiry and TC5 55k Middle East Gulf / Japan is down 1.07 points to WS110.36 a round-trip TCE of $4388/day. The MRs have shown an incremental improvement and 35k Middle East Gulf / East Africa (TC17) has crept up around WS7 points into the low 180s. In the Mediterranean, the Handymax rates have remained flat from enquiry petering out during the week. TC6 30kt Skikda / Lavera is now at WS 140.63 (- WS 3.12). The LR2s, TC15 80k Mediterranean / Japan have just had enough sentiment to hold on at levels from last week and are still in the $2.35m region for the moment. The Baltic Handy market showed a consistently firming sentiment this week and has been tested upwards. TC9 30k Baltic / UK-Continent is now WS 168.57 (+WS 15)

On the UK-Continent, MRs have again had a busy fixing week with freight levels continuing to rally. TC2 37k UK-Continent / US Atlantic Coast is currently marked at WS158.57 (+WS29.68). TC19 37k Amsterdam to Lagos has followed suit and is currently at WS164.64 up 31.78 points. On the LR1s, TC16 60k Amsterdam / Offshore Lomé has had a boost from the active MRs in the region and climbed WS3.21 points to WS140. In the Americas the owners will have sought respite in the holiday weekend from the freight rates that were consistently under pressure at the beginning of the week. TC14 38k US Gulf / UK-Continent dropped to WS 85.36 (-WS 11.78) and TC18 38k from US Gulf / Brazil also fell 16.07 points to WS 140.36.

Headquartered in London and a subsidiary of the Singapore Exchange (SGX), the Baltic Exchange publishes a range of indices and assessments which provide an accurate and independent benchmark of the cost of transporting commodities and goods by sea. These include the Baltic Dry Index (BDI), the dry bulk shipping industry's best known indicator. Published daily since 1985, this provides a snapshot of the daily spot market earnings of capesize, panamax and supramax vessel types on the world's key trading routes.

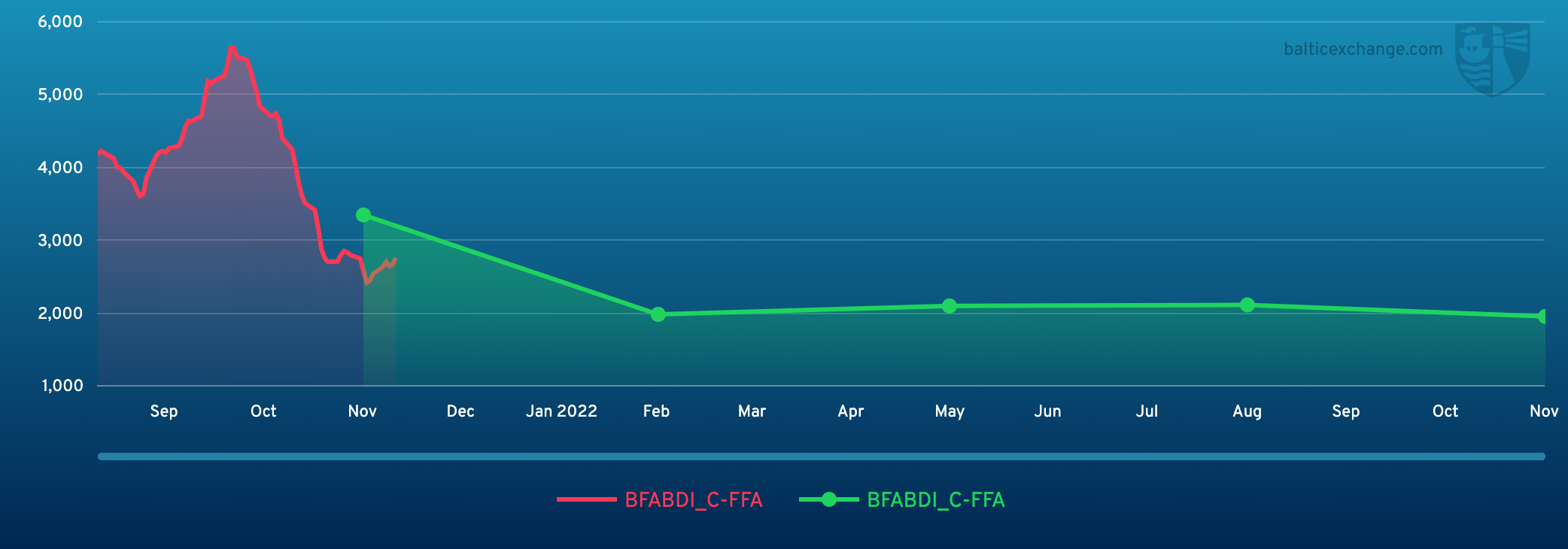

Chart shows Baltic Dry Index (BDI) during Nov.26, 2020 to Nov.26, 2021

Baltic Forward Assessment for BDI

In March 2018 the BDI was re-weighted and is published using the following ratios of time charter assessments: 40 percent capesize, 30 percent panamax and 30 percent supramax. The information is provided by a panel of international shipbrokers.