China steps up imports amid consumption upgrading

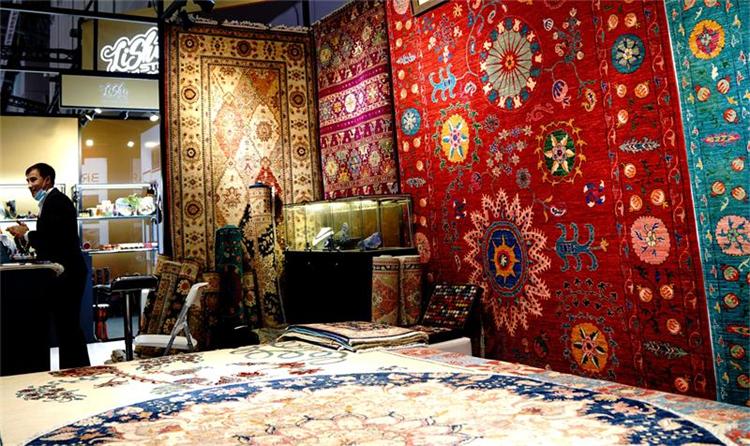

Photo taken on Nov. 6, 2021 shows a booth displaying handmade woolen carpets from Afghanistan during the 4th China International Import Expo (CIIE) in east China's Shanghai. (Xinhua/Zhang Jiansong)

China has been expanding its import of consumer goods as residents' income increases and consumption upgrading unfolds alongside economic development. Supermarkets for imported goods and international commodity exhibition and trading centers are emerging one after another, enabling Chinese consumers to buy goods from all over the world.

Increasing imports can promote domestic industrial upgrading and optimize supply-demand structure, while bringing more high quality commodities from foreign countries to the Chinese market through efficient supply chains.

The burgeoning market of consumer goods in China is attracting heavier investment from foreign businesses.

-- Import growth boosted by consumption upgrading

As China's economy grows, residents' income increase and consumption upgrading have become a major driving force for the import of consumer goods, said Lin Jiang, senior researcher with the JD Research Institute for Consumption and Industrial Development.

China's middle-income group keeps expanding in recent years, suggesting a steady growth in residents' income. In 2021, the country's per capita GDP exceeded 12,000 U.S. dollars, with the per capita disposable income reaching 35,000 yuan (about 5,250 U.S. dollars).

Import of consumer goods is stimulated by such a solid consumption basis. In 2021, China's consumer goods import increased 9.9 percent year on year.

Supermarkets for imported goods and international commodity exhibition and trading centers are emerging one after another, allowing consumers to buy goods from all over the world.

During the Spring Festival, Greenland Holding Group and participants of China International Import Expo (CIIE) launched a fair service for consumers to customize their gift packs by selecting products out of the over 1,000 CIIE exhibits from 40 countries and regions, including camel skin lamps from Pakistan, honey from New Zealand, and Mate tea from Argentina.

During the holiday, the fair generated an income of over 200,000 yuan every day, with consumer visits standing at more than 10,000. It became a new place for consumers to buy CIIE commodities and experience diverse cultures, according to Xue Yingjie, executive assistant with Greenland Holding Group.

E-commerce platforms, backed by their strong international supply chains, are serving as a gateway for international brands to reach the Chinese market.

For instance, JD Worldwide, the cross-border e-commerce platform of the Chinese e-commerce giant JD.com, prepared a huge amount of bestsellers from internationally famous brands and offered generous discounts to Chinese consumers during the "618" mid-year online shopping festival.

During the first 24 hours after the online promotion event kicked off at 8 p.m. on May 31, JD Worldwide's transaction value of cross-border food, beverage and fresh products surged 160 year on year, in which imported alcoholic beverages went up 9 times compared with a year before. Sales of imported small kitchen appliances jumped 128 percent year on year, and that of imported electronic education devices soared 17 times year on year, according to data released by JD Worldwide.

Expanding imports not only secures the supply of quality consumer goods, but also enables foreign and domestic markets to reinforce each other, said Lin Jiang, adding that importing more high quality goods would help optimize supply-demand structure and further unleash the vitality of domestic consumption market.

-- Import trade facilitated by better environment

In recent years, China has adopted comprehensive measures to facilitate import trade so that more high quality commodities are brought in to the Chinese market through efficient supply chains.

In 2018, China began piloting cross-border e-commerce retail imports, making it clear that retail goods imported through cross-border e-commerce platforms would be regulated as imports for personal use.

In 2021, the country expanded the piloting of cross-border e-commerce retail imports to all cities and regions where pilot free trade zones, comprehensive cross-border e-commerce pilot zones, comprehensive bonded zones, demonstration zones on import promotion, or bonded logistics centers are situated.

Cross-border e-commerce import have benefited from the pilot scheme expansion, said Shi Chenjia, general manager of NingShing Ubay International Trade Co., Ltd. in Ningbo Bonded Zone, east China's Zhejiang Province. In 2021, the company imported 35.87 million yuan of commodities from Central and Eastern Europe through cross-border e-commerce channels, showing an increase of 82.4 percent year on year.

In terms of tariffs, the Regional Comprehensive Economic Partnership (RCEP) agreement which came into force on January 1 eliminates tariffs on more than 90 percent of goods traded among RCEP members including 10 Association of Southeast Asian Nations (ASEAN) countries, China, Japan, the Republic of Korea (ROK), Australia, and New Zealand.

In other words, Chinese consumers can purchase quality products from other RCEP members at lower prices, said Gu Xueming, president of the Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce.

Shi added that under RCEP agreement, the tariff on noodles imported for the ROK, which currently stands at 9 percent, will decrease 0.75 percent every year to eventually zero tariff in 2034, thus giving a boost to import.

To better facilitate trade, China keeps improving business climate at ports. The time needed for customs clearance in December 2021 averaged 32.97 hours nationwide, 66.14 percent shorter than that in 2017.

-- Investment scaled up by foreign enterprises

Enjoying opportunities brought by China's consumption upgrading, many international brands and retailers are put more weight on the Chinese market.

Making its debut in CIIE in 2021, the international e-commerce giant Amazon showcased some of the best-selling overseas products such as clothing, shoes, cosmetics and kitchenware. Through the CIIE, Amazon hopes to further tap into China's cross-border retail market, according to Li Yanchuan, vice president of Amazon China.

Despite COVID-19 epidemic resurgence in some provinces and cities this year, foreign enterprises remain confident in the Chinese market.

Tim Hortons, an iconic Canadian coffee chain, plans to operate more than 800 stores in China by the end of this year, and over 2,750 by the end of 2026, according to Lu Yongchen, CEO of Tim Hortons China. As one of Canada's largest restaurant chains, Tim Hortons opened its first store in China in 2019. The company currently operates around 450 outlets across the country.

Lu expressed his confidence in the Chinese consumer market, especially the coffee market, saying that the coffee chain's investment in China will continue to increase.

Similarly, the Japanese major dairy industry company Meiji will also scale up investment in China.

Tamotsu Matsui, managing director of Meiji (China) Investment Co., Ltd., said identifying China as its most important overseas market, Meiji is building three plants in the country and investing rather heavily in AustAsia Investment Holdings Pte Ltd., which operates dairy farms in China. The value of the above-mentioned investment projects totals about 4.5 billion yuan.