Overseas markets drive PV module shipments of listed Chinese PV companies

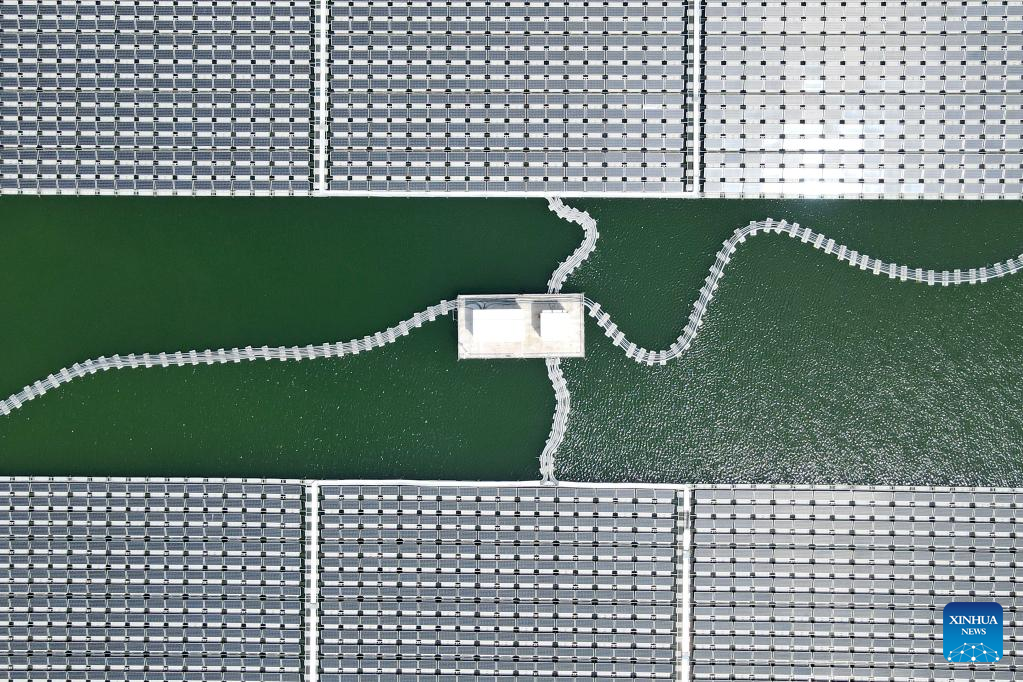

Aerial photo taken on Aug. 25, 2022 shows a view of Maowei floating photovoltaic power station on water in Gucheng Township of Yingshang County, east China's Anhui Province.(Xinhua/Huang Bohan)

Many listed Chinese companies in the photovoltaic (PV) industry have recently disclosed their half-year reports which show that overseas markets have contributed a lot to the shipments of PV modules of these companies, reported stcn.com Monday.

According to the reports, the top four listed firms in the PV industry in terms of PV module shipments in the first half of 2022 are respectively Jinko Solar Co., Ltd. (Jinko Solar, 688223.SH), Trina Solar Co., Ltd. (Trina Solar, 688599.SH), LONGi Green Energy Technology Co., Ltd. (LONGi, 601012.SH) and JA Solar Technology Co., Ltd. (JA Solar, 002459.SZ).

The European market took the largest share in the destinations of PV module shipments of Jinko Solar, and China, the Asia-Pacific region and the emerging markets also contributed a lot.

In the European market, Jinko Solar has pocketed a large number of orders and reached high premium levels in its N-type Tiger Neo series of PV module products, while in Latin America, India and other markets, the company has also seized market opportunities to achieve rapid growth through early layouts.

Trina Solar said that in the second half of 2022, the company's PV module shipments in the U.S. market returned to normal, posing a significant increase compared with the first half of the year, with the total amount throughout the year expected to exceed 2GW.

LONGi said that in the first half of this year, the company has shifted its sales focus to Europe and other important markets, and thanks to the long-term accumulation in products and services, brand recognition and channel layouts, it has maintained good competitiveness, with overseas business basically stable.

JA Solar has seen its overseas shipments of PV modules account for about 67 percent of its total PV module shipments during this period.

According to the company, while stabilizing major PV markets such as China, Europe, the United States and Japan, it is actively expanding into emerging markets such as Southeast Asia, Australia, Central America, South America and the Middle East.

Regarding the sustainability of overseas demands, JA Solar believes that there is a high possibility of a cold winter in Europe this year, which may lead to a shortage of natural gas supply and high electricity prices, and thus the demand for PV modules in the fourth quarter of this year in Europe may be better than usual.